News releases

FWD Group announces strong first half 2024 financial results

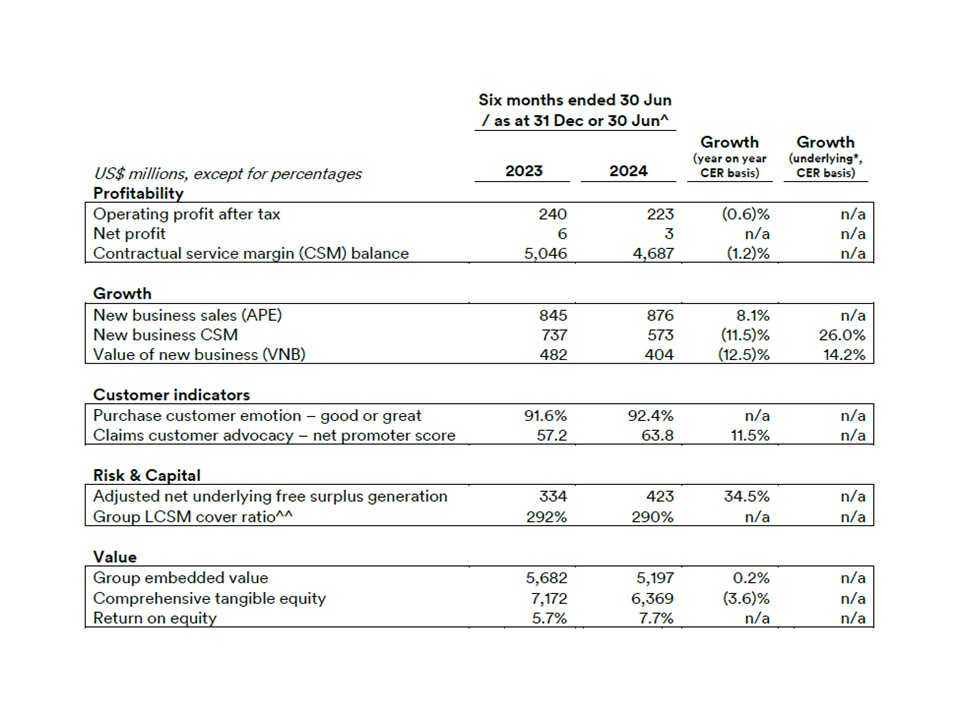

FWD Group Holdings Limited (“FWD Group” or “FWD”) today announced strong half year results for the six months ended 30 June 2024.

- Operating profit after tax of US$223 million, reflecting positive contributions from all four geographic business segments – Hong Kong SAR & Macau SAR; Thailand & Cambodia; Japan; and Emerging Markets. Record dividends of over US$600 million year to date received from geographic business segments.

- New business contractual service margin of US$573 million, with underlyingi year-on-year growth of 26 percent. Value of new business of US$404 million, with underlying year-on-year growth of 14 percent.

- Successfully issued US$1.5 billion in 2024 of subordinated notes due 2029 and 2031 to refinance debt securities; additionally, total undrawn committed credit facilities are US$1.185 billion.

- Announced new FWD HealthyMe business in May, which aims to be a partner to customers across Asia for their lifelong health needs, utilising the latest developments in health technology and research to provide diagnostic services alongside comprehensive accident and health insurance.

- Ranked number six in the 2024 Million Dollar Round Table (“MDRT”) Top 10 Multinational Companies rankings in July, for the third consecutive year. MDRT is a global independent association recognised as a standard of excellence for members serving clients in the industry.

Huynh Thanh Phong, Group Chief Executive Officer and Executive Director of FWD Group, said, “We’re pleased to report solid financial results, demonstrating organic growth and operating profitability across FWD Group. Our performance reflects the scale we’re building across our 10 markets in Asia and our focus on sustainable profitability.

“We’re more determined than ever to give our customers the freedom to celebrate living, both now and in the future. That’s also the driving force behind our new FWD HealthyMe business, which builds upon our existing life insurance, critical illness and medical offerings with comprehensive accident and health insurance,” added Huynh Thanh Phong.

All four geographic business segments – Hong Kong SAR & Macau SAR; Thailand & Cambodia; Japan; and Emerging Markets – delivered operating profitability during the first six months of 2024, after reaching this milestone for the first time in 2023.

The Hong Kong SAR & Macau SAR segment delivered another strong performance, reflecting substantial growth from mainland Chinese visitors as well as robust local demand for quality insurance products. Thailand posted a solid contribution, reflecting a product mix shift to higher margin products. Growth in Japan demonstrated sustained focus on individual protection products. In Emerging Markets, strong growth was partly offset by ongoing market disruption in Vietnam.

About FWD Group

FWD Group is a pan-Asian life and health insurance business with more than 12 million customers across 10 markets, including some of the fastest-growing insurance markets in the world. The company was established in 2013 and is focused on changing the way people feel about insurance. FWD’s customer-led and digitally enabled approach aims to deliver innovative propositions, easy-to-understand products and a simpler insurance experience.

For more information, please visit www.fwd.com

i * VNB and new business CSM on an underlying basis assumes changes to actuarial methods and operating assumptions as of year-end 2023 to reflect latest post-COVID experience and market disruption in Vietnam are retrospectively applied and also includes costs associated with agency recruitment programmes.

^The results are for the six months ended 30 June 2024 and compared to the same period in 2023. CSM balance, Group LCSM cover ratio, group embedded value, comprehensive tangible equity and return on equity 2023 values are December 2023 balances/ratios and growth rates are shown accordingly.

Growth rates are represented on a constant exchange rate (CER) basis. Except for operating profit/(loss) after tax (non-IFRS measure), net profit/(loss), CSM, and comprehensive tangible equity, all other numbers are unaudited.

New business sales are calculated on an annual premium equivalent (APE) basis, based on 100 percent annual premiums and 10 percent single premiums. Operating profit after tax and net profit after tax presented are net of non-controlling interests.

^^Prescribed capital requirement (PCR) basis